Payment means

Introduction

Every business transaction can be conducted by a range of various payment collection methods depending on the amount involved, the settlement period, the type of customer, the nature of the business relationship between buyer and seller, the country in which the buyer is based, the payment customs of the particular industry or country and so on. No company that exports on a regular basis to a variety of countries uses the same payment collection method all the time. This is why it is important to have a wide range of methods available, each with its own characteristics. The choice of payment method needs to take into account the following factors:

- Flexibility, although this tends to be incompatible with security.

- Security, which in turn has cost implications (the more secure, the more expensive).

- The parties’ ability to negotiate (if you want to sell, it is sometimes necessary to accept an unwelcome risk when the buyer is not prepared to pay the higher price that your peace of mind would cost).

- The characteristics of the buyer’s country, since it is advisable with some countries (where international payments are problematic) to take additional precautions, regardless of the customer’s solvency.

- Finance. The way in which the business transaction is financed varies from one payment collection method to the next; and it is frequently indispensible if it is to be successfully concluded.

To know what international payment means are available locally, please contact your Santander branch for more information.

Banknotes

Foreign banknotes are hardly ever used as a payment method in the context of international business transactions. The drawbacks can be summarized under Risks and Costs.

- Risks: of forgery, theft, loss and exchange

- Costs: handling, transport, insurance and other costs mean currency exchange operations work out more expensive.

In addition, some countries have currency control regulations in place which may cause impediments.

Cheques

Personal Cheque

Description

This is issued by the holder of a current account at a banking institution against the funds that he or she has deposited there, and may be made out either to a named individual or the bearer. The exporter has no guarantee of being paid for the merchandise, despite having received the cheque, because payment depends on the validity of the drawer’s signature and whether or not there are sufficient funds in the account. The fulfilment of personal cheques is subject to the laws of the importer’s country, because there are some countries in which this form of paying for foreign goods is not permitted.

Apart from the risks associated with possible non-payment on the part of the buyer, there is also the problem of losing title to the goods, because all the commercial documents (invoice, shipping paperwork, insurance and so on) are sent directly to the importer. Personal cheques are used as an international payment method when there is a considerable degree of trust between the exporter and the importer.

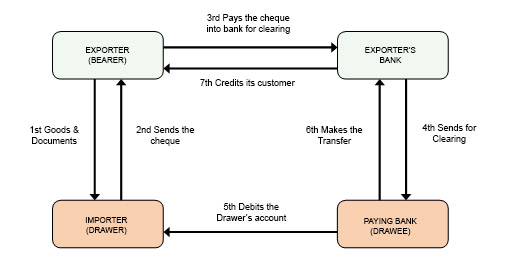

Parties involved

- Drawer: Person who issues the cheque.

- Drawee: Deposit-taking individual or institution where the drawer keeps his or her funds (usually a financial entity).

- Bearer: Person who collects payment on the cheque.

Process

- The Exporter (Seller) sends the merchandise and documents to the Importer (Buyer)

- The Importer (Buyer) sends the Exporter (Seller), after an agreed period of time, a cheque in foreign exchange

- When the Exporter receives the cheque he pays it into his bank to initiate the collection of funds

- The Exporter’s bank arranges collection with the Paying bank

- The Paying bank debits the Importer’s account

- The Paying bank makes the transfer to the Exporter’s bank

- The amount is credited to the Exporter

Banker’s Draft

Description

This is a document issued by a bank at the request of an importer based in the same country, drawn against the bank itself or against another banking entity, normally located in another country, and made out to the exporter who is awaiting payment. Although there is no legal bar to doing so, it is not advisable to make these payable to the bearer. There is a major difference between drafts and personal cheques: a personal cheque is issued by someone against his or her current account, while a banker’s draft is made out by the issuing bank against the current account it has with the drawee bank. The advantage for the exporter lies in the fact that the payment commitment rests with the drawing bank/the bank that issued the draft. From the exporter’s perspective, the banking transaction takes place faster and more smoothly than with a personal cheque, especially if the bank in question enjoys a reputation for solvency and is located in a stable country.

Exporters are advised to use this payment method only in cases where there is a high degree of trust, the draft has been issued by a reputable bank and the country is not showing signs of default.

Parties involved

- Drawer: The bank responsible for issuing the draft, drawn against its own funds

- Drawee: The issuing bank’s local correspondent bank (there does not necessarily have to be a drawee or paying bank)

- Importer: The individual or entity requesting the draft

- Bearer: The exporter of the goods, who collects payment on the draft

Process

- The Exporter (Seller) sends the goods and documents to the Importer (Buyer)

- The Importer (Buyer) requests a banker’s draft from its bank

- The issuing bank debits the customer’s account and sends the draft to the customer

- The Importer sends the draft to the Exporter

- The Exporter pays the draft into the paying bank for processing

- The paying bank credits the draft to the Exporter

- The paying bank simultaneously debits the value of the transaction from the issuing bank’s account

Payment orders

Description

This is the payment method whereby the principal (importer) requests its bank to credit the account of the beneficiary (exporter) via a second bank (correspondent bank) with a specific sum of money. The transfer must state the reason for the payment.

The advantages of using this type of payment rather than cheques stem from the fact that it avoids such pitfalls as getting lost in transit, signatures being forged and so on.

This payment method is applied to cross-border sales and purchases of goods when there is a high degree of trust between the importer and exporter: the exporter continues shipping goods and documents in the confident expectation that the importer will honour its obligations.

Parties involved

- Principal: Individual or entity who requests the issuing bank to issue the payment order

- Issuing bank: The bank that issues the payment order

- Paying bank: The bank that makes the payment, usually a correspondent bank for the issuing bank

- Beneficiary: An individual or entity

Process

- The Exporter sends the goods to the Importer with the accompanying paperwork.

- The Importer instructs its bank to proceed with the transfer.

- The issuing bank debits the amount from its customer’s account.

- The issuing bank sends the transfer instructions to the paying bank, simultaneously crediting the amount.

- The paying bank credits the sum to the Exporter.

Remittances

Description

This is a banking transaction in which the exporter enlists the help of his bank to manage the collection of certain financial documents (promissory notes, IOUs, cheques and so on) and/or non-financial documents (invoices, bills of lading, plant health certificates and so on), in exchange for a commitment or payment on receipt on the part of the importer. Depending on whether the documents are financial or non-financial, the remittance is known as ‘simple’ or ‘documented’. The legal framework is set out by the International Chamber of Commerce in its UNIFORM RULESconcerning the collection of debts.

Parties involved

- Principal: It is the exporter who takes the initiative in the operation and hands over the financial and non-financial documents to its bank; the bank then oversees the collection of the debts and becomes the beneficiary of funds collected.

- Remitting bank: The exporter’s bank, entrusted by the exporter with managing the collection of the remittance. A bank chosen by the exporter forwards the documents.

- Collecting bank: This must be different from the remitting bank. It receives the documents from the latter and presents them to the importer for acceptance or payment. If it presents the documents to the importer (drawee) it acts as the presenting bank.

- Drawee: This is the importer to whom the documents are presented for a commitment to pay or payment.

Process

- The Exporter sends the goods to the customs authorities of the destination country.

- The Exporter sends the documents – both financial and commercial – to the remitting bank.

- The remitting bank forwards the documents to the collecting bank.

- The collecting bank contacts the Importer.

- The importer pays or accepts a bill in exchange for the documents.

- The collecting bank reimburses the amount to the remitting bank.

- The remitting bank credits the exporter.

Simple remittance

With simple collections, the exporter sends the goods and the commercial documents directly to the importer and sends the financial paperwork separately via a financial institution, generally for a commitment to pay or actual payment. The originator must give precise and comprehensive instructions about how to proceed in the event of non-payment or any other legal formality that replaces them, as well as who must pay the charges and fees.

As far as risks are concerned, this payment method requires the exporter to take on virtually all the risks: by sending the commercial paperwork directly to the importer he loses title to the goods and incurs the risk of the former refusing to pay or commit to pay, as well as possible pitfalls stemming from the risks inherent in the country concerned.

Process

- Contract is signed, order is accepted, etc.

- The exporter sends the goods and the commercial paperwork to the importer, incurring all the risk from this moment onwards.

- The seller himself asks his bank to send the importer the bill of exchange.

- The exporting bank sends the remittance to the presenting bank.

- The importer/drawee receives the bill of exchange via the presenting bank.

- The buyer makes the payment.

- and 8. The exporter is reimbursed and paid.

Documentary remittance

With this method the exporter supplies his bank with various trading documents (invoices, bills of lading, plant health certificates and so on), possibly accompanied by a financial instrument (bill of exchange, IOU, receipt and so on), and instructions that they be delivered to the foreign importer, via his bank, against payment or commitment to pay for the financial instrument.

It is important to bear in mind that the exporter may face a situation in which the buyer rejects the goods; this may mean that, although they are still owned by him, they are located in a distant country and, as a consequence, he is confronted with additional storage charges, shipping costs in the event of having to re-import them, and even losses or penalties for delaying despatch.

Process

1. Signing of contract, acceptance of order and so on.

2. The exporter sends the goods.

3. The paperwork certifying the despatch is received by the exporter.

4. The seller then goes to his bank with instructions for delivering the commercial paperwork to the buyer against the bill of exchange.

5 and 6. The exporter’s bank manages the transaction through the presenting bank, thereby reaching the importer.

7. After checking the paperwork, the importer/drawee accepts the bill of exchange.

8. and 9. The presenting bank gives him the commercial paperwork and proceeds to return the accepted bill of exchange to the exporter, via his bank.

10. and 11. The importer takes possession of the goods with the documents obtained.

Documentary credits

This encompasses all agreements, regardless of their name or description, whereby a bank (the issuing bank), acting at the request of and in accordance with the instructions of a customer (the principal) or on its own behalf:

- Agrees to make a payment to a third party (the beneficiary) or on his instructions, or accept and pay bills of exchange (negotiable instruments) made out by the beneficiary,

- Authorizes another bank to make the payment or accept and pay such bills of exchange (negotiable instruments)

- Authorizes another bank to negotiate, against the delivery of the stipulated paperwork, provided that the terms and condition of the credit are fulfilled.

- Documentary credit is therefore the most secure payment method both for the exporter, who knows in advance that if he meets the conditions he will be paid, as well as for the importer, who knows that he will pay only if the paperwork he has requested is given to him in order.

The legal framework is summarized by the International Chamber of Commerce and set out in the UNIFORM CUSTOMS AND PRACTICE FOR DOCUMENTARY CREDITS.

Parties involved

The parties involved in a documentary credit (or letter of credit) are:

- The importer or principal.

- The exporter or beneficiary.

- The issuing bank.

- The notifying bank.

Process

- The importer submits a request to the issuing bank in writing to open a documentary credit.

- Having conducted a risk assessment, the bank issues a documentary credit to the beneficiary.

- The notifying bank informs the beneficiary of the opening of the documentary credit.

- The exporter ships the goods to the destination country.

- The beneficiary delivers the paperwork to the notifying bank.

- The notifying bank sends the documents received to the issuing bank.

- The issuing bank pays the notifying bank.

- The notifying bank credits the beneficiary.

- The issuing bank debits the importer’s account and gives him the paperwork.

- The importer presents the paperwork to customs and takes possession of the goods.

Classification of documentary credits

Depending on the commitment of the issuing bank

Irrevocable credits

The UCP 600 states that documentary credits are always irrevocable (even when this is not mentioned). This means that documentary credits cannot be cancelled or modified under any circumstances, unless it is by the agreement of all the parties concerned (not only the principal and the beneficiary, but also the issuing and notifying banks).

Confirmed credits

The issuing bank requests an intermediary bank to add its ratification, in other words that it completely takes on the obligations it has towards the beneficiary. The security of the beneficiary is enhanced with these credits, since the risk associated with individual countries tends to be eliminated.

Non-confirmed credits

These are credits in which the intermediary bank adds no commitment whatsoever, limiting its role to notifying the beneficiary of the credit’s terms of use.

Depending on the place of payment:

Credits payable in the issuing bank’s branches

It takes longer to collect payment in this case, because the paperwork has to be presented to the issuing bank before the payment is released.

Credits payable in the intermediary bank’s branches

The collection of payment is instantaneous upon presentation of the correct paperwork.

Credits payable in the branches of a third party bank (confirming bank)

This is used in circumstances when the credit is denominated in a currency that differs from both the beneficiary’s and the issuer’s native currency and/or there is mutual mistrust with the issuing bank.

Depending on how they are used:

Payment

- On-demand credits Payment is made upon presentation of the required paperwork, provided it is in order.

- Term credits Payment is made when an agreed time has elapsed, starting from a specified date.

Acceptance

The bank undertakes to accept the bills drawn on its account or that of the principal.

Negotiation

The bank undertakes to discount without recourse concerning the drawer.

Other types of credit

- Transferable credits These are credits that enable the beneficiary to give instructions to the notifying bank to transfer the credit wholly or in part to a third party or parties, who are known as second beneficiaries, normally for a smaller amount and a shorter time.

- Non-transferable credits Credits that do not have the transferability feature.

- Revolving credits These are credits that, once a period has elapsed or an amount has been exhausted, recuperate their original value and can be reused. There are two types: accumulative, which make available some time not used in the preceding period, and non-accumulative, in which time not used in previous periods may not be used in subsequent ones.

- Back-to-Back credits These are credits opened at the request of a principal, who in turn is the beneficiary of another documentary credit, which he uses to guarantee the one he is requesting.

- Red clause credits These are credits that authorize the bank that is obliged to make the payment to make advances to the beneficiary, with the idea that the latter should set about acquiring goods or raw materials in order to manufacture whatever is the subject of the documentary credit.

- Green clause credits Similar to red clause credits, but more requirements are stipulated for the advances to be made.

- Standby credits A method that is used to finance the payment of an obligation taken on by a principal in favour of a beneficiary, arising as a consequence of the repayment of loans, payment of bills, supply of merchandise and so on.

This type of documentary credit acts as a guarantee and is used above all in the USA where by law banks are not permitted to issue guarantees in the sense that this concept is understood in Europe.

The legal framework is summarized by the International Chamber of Commerce and comprises INTERNATIONAL PRACTICE concerning STANDBY CREDIT (http://www.iccwbo.org/ )